Lesson 2: Assets, Liabilities, Net Worth

Scroll down for some thought questions and case study examples or download discussion in a PDF file.

#1: What are some examples of assets?

Anything you own that has value can be considered an asset. Obviously, some assets are more valuable than others. Your home, as long as you take reasonable care of it, has the potential to increase in value over the years, while your car (although technically an asset) will probably decrease in value continually from the moment you purchase it. Your other possessions, such as jewelry, furniture, televisions, boats, etc. would all be considered assets, though it is often difficult to determine the value of all of these things. Additionally, assets don’t have to be physical things. Your savings account, your stock portfolio and your life insurance policy are all examples of assets that are considered when determining your net worth.

#2: What are some examples of liabilities?

Anything that you owe to someone else is considered a liability. Any loans that you have, whether student loans, auto, home or otherwise are considered liabilities. The amount of the liability is the amount that you currently owe, not the amount that you originally borrowed. Credit card debt and gambling debts would also be considered liabilities.

#3: Can some things be both an asset and a liability?

Sure! Spouses, children, parents, a PhD, Bill Clinton… these could all be considered by some to be both assets and liabilities. But when we are speaking in financial terms, the answer is no. For example, your home is an asset (the value of which is determined by the current real estate market), but the amount you still owe on the mortgage for that home is a liability. Though it seems like the home then becomes both asset and liability, it is technically only the mortgage that is a liability. The home itself is purely an asset.

#4: Is "nominal value" just a shorter and fancier (financier?) way to say: "the amount, in dollars, that is paid for something when it is bought or sold, or the number of dollars something contains”?

For our purposes, yes. The nominal value represents the amount in dollars before any adjustments are made for inflation or other factors.

#5: What are some examples of things that are included in the Consumer Price Index Market Basket?

Costs for food, housing, transportation, fuel, medical care and education are all included in the Market Basket, as are many other expenses.

#6: Why is it valuable to know my net worth?

Net worth is an indicator of how you are allocating your lifetime resources between now and later. A positive net worth means that your assets exceed your liabilities. Consequently, you are carrying forward some real value that can be used to smooth out future financial bumps. A negative net worth means that on balance Future You is supporting Present You. Being aware of these trends can be important when making new financial decisions; you will know how much of your “value” has already been shifted in time. There is no “right” number.

#7: Suppose the Consumer Market Basket costs $100 in the base year 2013. We then say that the CPI (Consumer Price Index) is equal to 100 in the base year of 2013. If the cost of the same Consumer Market Basket rises to $105 in the year 2014, what is the value of the CPI in 2014 using the base year 2013?

Recall the formula for calculating a percentage change:

Percentage Change = 100 X (New Value - Old Value) / (Old Value)

Thus, the percentage change in this example = 100 X ($105 - $100) / $100 = 5%. The percentage change in the CPI is called the inflation rate. Hence, the inflation rate from 2013 to 2014 is 5% in this example. To calculate the CPI in 2014, using the base year 2013, we would add the rate of inflation to the CPI from the base year, resulting in a CPI of 105 for 2014.

For more information about the CPI and the inflation rate, refer to Module 1 "Resources."

#8: As in the preceding question, suppose the CPI using the base year 2013 is 100 in 2013 and 105 in 2014. In addition, suppose you bought a house in 2013 for $200,000 and sold it for $204,000 in 2014. What would the real price of the house be in 2014 using 2013 as the base year?

Remember Professor Bartlett's formula for the real value of an asset?

Real Value = (Nominal Value / Price Index) X 100

Thus the real value of the house in 2014 would be:

($204,000 / 105) X 100 = $194,286

The real value has declined because the percentage change in the CPI (5%) exceeded the percentage increase in the (nominal) price of the house, which was 2%. In other words, the inflation rate went up faster than the price of your house did.

#9: Why is the value of the $5 bill in Professor Bartlett's presentation "elastic"?

The $5 bill will always be worth $5 (its nominal value), but its real value (i.e., its purchasing power), determined by the amount of goods and services it will buy, is likely to change. If the CPI rises, $5 will buy fewer goods and services and the real value of the $5 bill will shrink. If the CPI falls (which it rarely does outside of Japan), $5 will buy more goods and services and the real value of the $5 bill will expand. Thus, the value of the $5 bill can expand or contract... just like an elastic!

Continuing example stories from three different stages in life.

Having even a general sense of your net worth can be a valuable financial tool, whether you are trying to save for retirement or looking to buy your first house. In fact, if you go to the bank for a mortgage, they will most likely hand you a set of forms on which you will effectively be calculating your net worth.

Just for illustration, let’s calculate the present financial net worth for each of our Smithies:

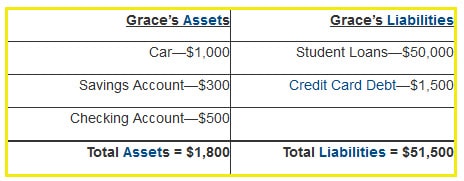

Grace, recent graduate, 24

As you can see below, Grace currently possesses few assets but also few liabilities, so her net worth is relatively easy to calculate.

If we cash Grace out and pay all her debts, what (if anything) is left over? Whatever remains will be her current net worth. To determine Grace’s net worth, we must subtract her total liabilities from her total assets:

Grace’s current net worth is -$49,700. Right now, she has a negative net worth, which means “Future Grace” (with some help from “Present Grace’s” parents) is currently supporting “Present Grace.”

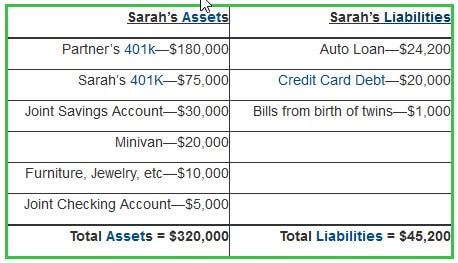

Sarah, entrepreneur, 39

Being a little older than Grace, Sarah has more assets and more liabilities, making it a bit more complicated to calculate her net worth. Since she is married and shares all of her resources with her spouse, we will actually be calculating the net worth of the two of them as a couple.

Being a little older than Grace, Sarah has more assets and more liabilities, making it a bit more complicated to calculate her net worth. Since she is married and shares all of her resources with her spouse, we will actually be calculating the net worth of the two of them as a couple.

If we cash Sarah out and pay all her debts, what (if anything) is left over? Whatever remains will be her current net worth. To determine Sarah’s net worth, we must subtract her total liabilities from her total assets:

Sarah’s current net worth is $274,800. Right now she has a positive net worth, which means “Present Sarah” currently has enough resources to help support “Future Sarah,” so long as she avoids any serious financial pitfalls. However, Sarah and her partner have some new upcoming expenses to consider and they know that it is too early in life to be unnecessarily drawing down their assets. Knowing their net worth can be a useful tool as they try to make educated financial decisions.

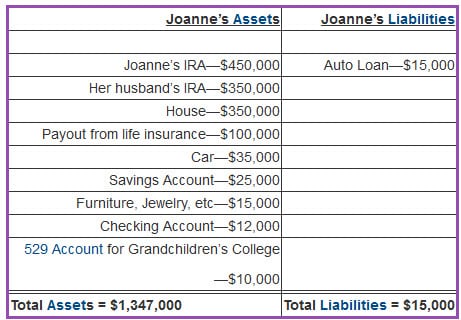

Joanne, artist and activist, 66

After years of saving, Joanne has many more assets than either Grace or Sarah. And since she has been prudent with her money, she has paid off most of her debts.

If we cash Joanne out and pay all her debts, what (if anything) is left over? Whatever remains will be her current net worth. To determine Joanne’s net worth, we must subtract her total liabilities from her total assets:

Joanne’s current net worth is $1,332,000. This shows that “Past Joanne” has set aside plenty of “value” to support “Present Joanne” and probably even “Future Joanne.” “Past Joanne’s” saving should help her to smooth out any financial waves that may come along during her upcoming retirement.