Lesson 2: Credit Reports and Credit Scores

Scroll down for some thought questions and case study examples or download discussion in a PDF file.

#1: How can I find out my credit score?

Everyone is entitled to get a free credit score from each of the three credit-reporting companies (Equifax, Experian, and TransUnion) every year. If you perform a Google search for “annual credit report,” you will find several sites where you can request them, but watch out for fraudulent sites. One reliable place is www.annualcreditreport.com. As this site notes, before you get your credit reports, you will be required to answer several detailed questions for which you may need to review old utility and credit card bills. These questions are included to ensure that nobody but you can get your credit information.#2: How are the different components that determine my credit score weighted?

Payment History 35%

Amount of Debt 30%

Length of Credit History 15%

# of New Credit Applications 10%

Types of Credit Used 10%

According to the FICO website, “these percentages are based on the importance of the five categories for the general population. For particular groups—for example, people who have not been using credit long—the relative importance of these categories may be different.”

#3: Will paying off my credit card debt help my credit score?

Yes. Any time you can reduce your debt, you will increase your credit score. Keep in mind, however, that if you never borrow any money or pay for anything with your credit card, your credit score will be lower than if you use your credit card consistently and pay off the balance every month.

#4: Will getting another credit card help my credit score?

That depends! Applying for new credit does not help your score immediately. In fact, it can even hurt your score, especially if you apply for multiple forms of new credit in a short period of time. However, if you get a new credit card and always make your payments on time, never go over your credit limit, and don’t run up any new debt, your score will increase over time.

#5: What do I do if I find an error in my credit report?

If you find an error in your credit report, you should contact the credit reporting agency immediately (Equifax, Experian, or TransUnion) and try to correct the error. It may take some work, but it’s worth it. You should also check your reports from the other credit reporting agencies (if you haven’t yet) and make sure they are error free.

#6: If I don’t have any credit or I have a low credit score, what are some good ways to start building credit and raising my credit score?

There are a number of ways to build credit and most of them come down to paying your bills on time and not going into debt. If you rent an apartment and pay utilities, pay those bills on time and in full every time; all that payment history goes into your credit report.

If you are worried about using a credit card for fear of ending up in debt, there are alternatives that you can use to help build your credit. Many credit card companies, banks, and credit unions offer cards that are secured by collateral that you provide; meaning that you cannot charge more than you have in your account—unlike credit cards, which are “unsecured” and allow you to charge up to your credit limit (and often beyond, accompanied by a hefty fee). There are also “credit builder” loans that are a type of secured loan designed to help you build credit. See Lesson 5 of this Module: Secured Loans and Debt for more information.

Continuing example stories from three different stages in life.

Lesson 2: Credit Reports and Credit Scores

Each of our Smithies has a credit score, whether they check it or not. Those three little numbers can significantly affect their financial options.

Grace, recent graduate, 24

Grace is thinking ahead, and she knows that her credit score will impact the things she wants to do in life – get an apartment, apply for a job, and one day buy a car and a home. So Grace requests her free copy of her credit report from each of the three major credit reporting agencies: TransUnion, Experian, and Equifax. There are no errors in the reports, which is good, but she notices that she has one red box for the time she paid her credit card bill two days late. She wonders how that affected her credit score, so she pays one of the companies to find out her score.

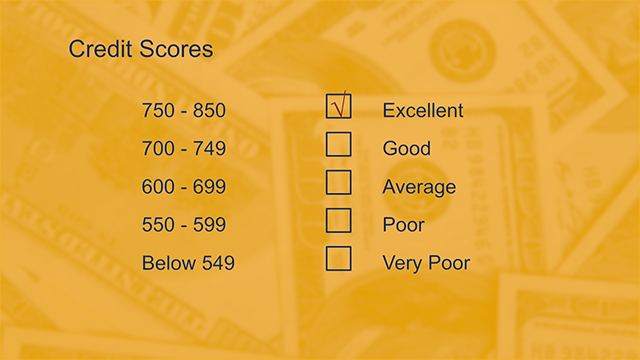

Grace’s credit score is 600, which is in the “average” range. Her parents tell her that her score is probably low because she only has two types of credit (credit card and student loans) with only 2 years of history, including one month paid late.

The actions Grace takes now will have significant consequences for "Future Grace." If Grace continues to pay her credit card on time, stays well under her credit limit, and doesn’t apply for too many new loans at once, she will build up a good credit history and her score will increase. In five years, if she applies for a mortgage, she’ll get a good rate, which means she’ll have to pay less in interest for her home.

On the other hand, if Grace doesn’t pay her bills on time, maxes out her credit card or gets her account closed (due to failure to pay), her credit score will drop and she will be doing major financial harm to "Future Grace." She might not be approved for a mortgage at all in five years, and may find it difficult to rent an apartment, finance a new car, or land some jobs.

Grace is young and may need to borrow a lot in the future. She should pay special attention to building an excellent credit score.

She has her whole future ahead of her – what a great place to be!

Sarah, entrepreneur, 39

Since Sarah and her partner are thinking of buying a home in the next few years, they decide to check their credit scores – to see what kind of a mortgage they will qualify for. After checking all six credit reports, they notice an error on Sarah’s partner’s report, and call Equifax to report it. It will be interesting to see how the scores change once the error is taken care of. It gets expensive to shell out enough money for six credit scores, but our young couple is very invested in their future home and family.

Sarah’s credit score is 750, which is considered good/excellent. She has over ten years of history paying her bills on time, and she has multiple types of loans – a car loan and three credit cards. Since she pays all these bills on time, she is considered a good credit risk.

Sarah’s partner, however, has a score of only 625, due to a couple of late payments and once where a card’s credit limit was exceeded. Sarah knows that both of their scores will be considered when they apply for a mortgage and is nervous that they might not get the best rate because of her partner’s relatively low credit score. Since banks also consider the couple’s income and they both make good money, they hope that this will balance their less-than-perfect credit scores.

As much as Sarah wants to buy a home right away, she thinks they should talk about taking a year or two to really focus on boosting their credit scores. Good thing they checked their credit reports and scores!

Joanne, artist and activist, 66

Joanne doesn’t have any debt, except for a new car loan, and she doesn’t intend to take out any more loans. Still, a commercial reminds Joanne that she’s entitled to a free credit report every year, and she decides to do it, just in case. What if the children need something, or what if she needs to renovate her home to sell it? Joanne knows that she has access to home equity loans she can use to borrow against the value of her (paid off) property. If she did have to draw on this credit, she’d want to know she could borrow at a competitive rate.

Joanne’s credit score is 820, which is considered excellent. She has forty years of credit history, and though she’s missed payments once or twice, she is considered an excellent credit risk. She’s paid off her house, a previous car loan, and kept no debt on her credit cards. When she applied for her recent car loan, she made sure the two dealerships engaged in a “soft” credit check, so that it wouldn’t look like she was applying for two loans. When Joanne checks her (long) credit report, she looks to make sure the dealerships really did engage in a “soft” credit check, because, she thinks, sometime they’ll say anything to get you in a new car.

An interesting question for Joanne is: Should she check her credit score if she is not planning to borrow any more in the future? The answer is YES! Joanne should regularly check her credit score to make sure that she is not a victim of identity theft. In addition, it is always possible that unanticipated needs may arise in the future that would require her to borrow.