Lesson 2: Moving From Gross Income to Taxable Income

How can I find out my tax bracket?

All taxpayers are entitled to claim a personal exemption for each member of the household. In Lesson 2, Professor Bartlett explains how further exclusions, adjustments, and deductions reduce a taxpayer’s tax burden and determine her marginal tax rate.

Scroll down for some thought questions and case study examples or download discussion in a PDF file.

#1: What is the difference between my average tax rate and my marginal tax rate?

Your average tax rate is equal to the percentage of your income that you pay in taxes. Your marginal tax rate is equal to the percentage of one additional dollar of income that would be paid in taxes. See the "Smith Stories" in this lesson for a numerical example.

#2: What does it mean if something is tax deductible?

If an expense is tax deductible, the IRS is effectively saying that it won’t count toward your taxable income when your taxes are calculated. A tax deduction results in a tax savings. You can find that savings by multiplying the amount of the particular expense by your marginal tax rate.

#3: Okay, I'm confused. Exemptions, adjustments, deductions, exclusions, credits...What are the differences between all of these terms?

All of these things will reduce your taxes. They have different names because the IRS treats them each a little differently. We could call them all “subtractions” or “modifications.” If you’re curious, here are some of the major differences:

Exclusions: These are types of income that the IRS has decided do not count towards your taxable income. For example, employer-paid health and dental plans are considered "income" by the IRS, but are not "taxable income." The same is true for employer contributions to your retirement plan.

Adjustments: These are expenses that can be subtracted from your income. For example, you can subtract moving expenses, alimony payments, and student loan interest payments from your income. And because these are adjustments (not deductions), they can be used in addition to the standard deduction.

Deductions: These expenses will be subtracted from your income next. Some examples are: charitable giving, mortgage interest payments, and state and local taxes. You can opt to either itemize (calculate the sum total) of your deductions or claim the “standard deduction,” whichever amount is higher. But you cannot do both.

Exemptions: An exemption is a set amount for each family member that the IRS has determined will not be taxed.

Credits: These are incentives from the government that are subtracted from your total taxes owed (instead of just from your taxable income). They can save you a lot of money if you qualify!

#4: How do I know if I qualify for exclusions, adjustments, deductions, exemptions, or credits?

It is rare that anyone actually goes and looks things up in the Internal Revenue Code (IRC) itself. The code is nearly incomprehensible. But there is a library's worth of guidebooks on how to do your taxes that can help you to find the answers you need. The IRS itself has publications and directions about each topic on its web site. You can also ask your tax preparer or check one of the tax software packages such as Turbo Tax. The next couple of lessons will cover some of the most common modifications to your income, but if you want more information you can find some helpful links in the "Resources" section at the end of this Module.

#5: What are the different measures of income and why do I need to know them?

Some credits and deductions require you to know these concepts in order to calculate your taxes. However, the important thing to understand is that through a series of subtractions, the IRS winnows down your "comprehensive income" until it reaches the number that is your "taxable income," upon which your taxes will be based.

Comprehensive Income

↓

Gross Income

↓

Adjusted Gross Income (AGI)

↓

Taxable Income

#6: Should I itemize my deductions or take the standard deduction?

It depends. Choose whichever route results in the bigger deduction. It will reduce your taxable income (and thus your total taxes) accordingly, so calculate carefully and choose wisely!

#7: What is the difference between by marginal tax rate and my "tax bracket"?

Your tax "bracket" is technically the range of taxable incomes for which your marginal tax rate is the same. For example, in 2013 the marginal tax rate for single taxpayers whose taxable incomes fell between $36,250 and $87,850 was 25%.

#8: How can I find my marginal tax rate?

If you know your taxable income, you can use a tax rate chart to determine your marginal tax rate. The video from this lesson shows the tax brackets for 2014. An updated chart can be found on the IRS's website, www.irs.gov. These rates can change each year, so make sure you are looking at tax rates for the correct year!

#9: Do I really pay my marginal tax rate?

Yes and no. You pay this rate on your highest layer of income. You pay a lower rate on the lower layers. Your average tax rate, however, will always be less than your marginal tax rate.

#10: What happens to my taxes if I claim someone as a dependent?

Having a dependent, such as a child under a certain age or a relative you take care of, will give you an additional exemption from your taxable income. It is essentially the same as having a second personal exemption. But you and your dependent cannot both claim the exemption.

#11: How do I benefit from capital gains tax laws?

Selling assets such as stocks or bonds at a profit qualifies as a capital gain. These kinds of income are taxed at a lower rate than many other kinds of income.

#12: At what rates are dividends and interest income taxed?

Most dividends are taxed at 15%, which is typically below the marginal tax rate paid by people who own stocks and bonds. Most interest is taxed at the same rate as income. Interest on municipal bonds, however, is tax-free.

#13: Don't I pay other kinds of taxes, too?

Absolutely. Most states have their own state income taxes, and some cities, like New York, even have their own city income taxes. People also pay Social Security and Medicare taxes, property taxes, and sales taxes.

Continuing example stories from three different stages in life.

Lesson 2: Moving from Gross Income to Taxable Income

The IRS will put our Smithies’ income into a magic formula to compute their taxes. But how exactly does that process work?

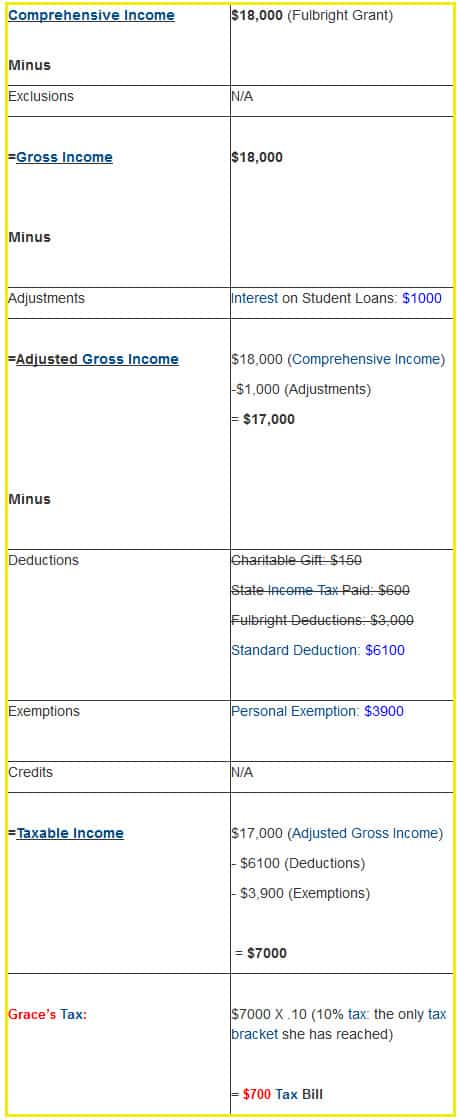

Grace, recent graduate, 24

As Grace attempts to do her taxes, she knows that the IRS will whittle her “comprehensive income” down to an amount that it will consider “taxable income.” It turns out that she does need to report her Fulbright grant as part of her comprehensive income. It seems that just as great teachers like Professor Bartlett cannot avoid Uncle Sam, neither can great students!

She was hoping that she would be eligible for some "exclusions," but she doesn’t have any insurance through her employer (she’s still covered by her parents’ health and dental plans), and she doesn’t have a retirement plan set up yet.

So, she moves on to the “adjustments” category. She didn’t have any qualifying moving expenses, she doesn’t yet contribute to an IRA, she certainly doesn’t pay any alimony… but she does pay interest on student loans! Finally, something to begin reducing her taxable income number! After making the appropriate calculations on the IRS form, she arrives at her “adjusted gross income.” But she’s not done yet.

Next come the “deductions” and “exemptions” categories. She did give a small sum of money to her favorite charity last year, so there’s a small deduction. She doesn’t own a home, so she’s not paying any mortgage interest, nor does she pay any property taxes, but there is a state income tax where she lives and this gives her another deduction to her federal taxable income. Although Grace could deduct many of her expenses abroad as a Fulbright Scholar, she calculates that the “standard deduction” will be greater than her itemized reductions, so she takes the “standard deduction” of $6,100 (in 2013).

Lastly, the IRS is apparently generous enough to give her an “exemption” just for being her! Who knew they were so giving?

Finally, she’s arrived at the golden number: her taxable income! She is amazed at how small the number really is. She falls well below the upper level of the lowest tax bracket, so all of her taxable income will only be taxed at 10%.

Below is a brief summary of Grace’s taxes:

In 2013, single taxpayers paid 10% of any taxable income between 0$ and $8,925 to the federal government in taxes. Grace's taxable income of $7,000 puts her below the upper boundary of $8,925. Consequently, if Grace's income rose by $1, she would pay $.10 more in taxes, and her current "marginal tax rate" would therefore be 10 percent.

Grace is curious as to what her "average tax rate" comes out to be. There are a few different ways to measure this. Some people choose gross income as the number they use to calculate their average tax rate, others use adjusted gross income, and still others use taxable income. Grace decides that using her gross income as a starting point to calculate her average tax rate is the easiest for her to comprehend.

Grace's tax bill of $700 represents $700(tax bill)/$18,000(Gross Income), or 3.9% of her gross income. So, using this measure of income, her average tax rate is 3.9%.

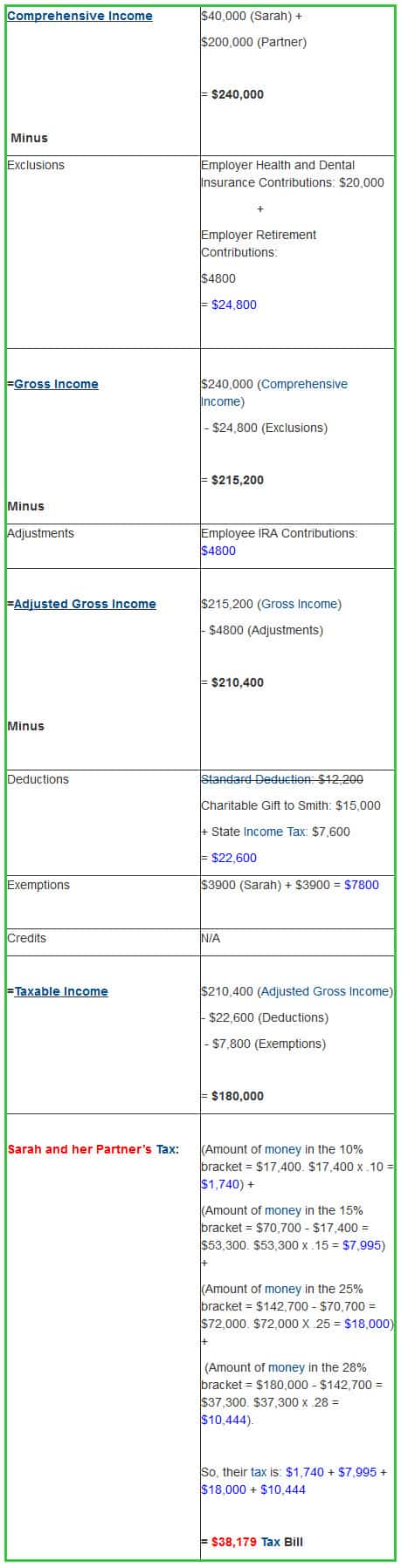

Sarah, entrepreneur, 39

After doing her own taxes for many years, Sarah knows how to calculate her taxable income. But she didn’t know how the tax brackets worked. She was under the impression that all income was taxed at the same rate and if your income increased enough to reach the next tax bracket, your “comprehensive income” would be taxed at the new, higher rate. She realizes that she shares the same misconception that confused Scrooge McDuck, only she doesn’t possess nearly his amount of wealth. Never again will she worry about making too much money (not that it was a huge worry anyway).

Sarah and her partner have money in all three of the categories that the IRS considers: taxable income, income never taxed, and income not taxed now.

Under the "taxable income" category, Sarah must include the wages and bonuses that both she and her partner have received through their jobs, her partner’s modest winnings at the casino, and even the small paycheck Sarah received from the magazine that ran her article about women and entrepreneurship.

Under the "income never taxed" category, Sarah and her partner receive health and dental insurance through her partner’s firm. Both of their employers also made contributions to their respective retirement accounts last year. None of this comprehensive income is taxable.

Additionally, the couple’s taxable income will be adjusted by the amount that they each contributed to their IRAs. They will, however, have to pay tax at some point on the money that they contribute to their retirement plans, depending on what type of plans they are contributing to. (See Lessons 3 and 4 of this Module for more information about the different types of IRAs or Individual Retirement Accounts.)

They both finished paying off their student loans about 5 years ago, so there is no longer an adjustment for student loan interest.

Sarah can also deduct from her “adjusted gross income” the monetary gift she gives annually to Smith. Since they don’t own a house (yet), she doesn’t have any mortgage interest to deduct, but she and her partner are both eligible for the personal exemption. Next year, they will be able to claim the twins as dependents and get a sizable tax credit.

Because Sarah and her partner file "jointly," they pay taxes according to a different tax table than the one used by either Grace or Joanne.

In the following table we can see how Sarah and her partner calculate their taxes:

Since Sarah's taxable income of $180,000 is well below the upper boundary of the 28% tax bracket, their taxes would rise by $.28 for every additional dollar of income, and their current "marginal tax rate" would therefore be 28%. This sounds like a high percentage until Sarah remembers that only the amount of their taxable income over $142,700 is taxed at that rate. In fact, almost half of their taxable income is taxed at 15% or less. That's a lot easier to swallow than if all of their income was taxed at the 28% rate, which is what she thought before she took this course!

Sarah is curious as to what her "average tax rate" comes out to be. There are a few different ways to measure this. Some people choose gross income as the number they use to calculate their average tax rate, others use adjusted gross income, and still others use taxable income. Sarah decides that using her gross income as a starting point to calculate her average tax rate is the easiest for her to comprehend.

Sarah's tax bill of $38,179 represents $38,179(tax bill) / $215,200(gross income), or 17.7% of her gross income. So, using this measure of income, her average tax rate is 17.7%.

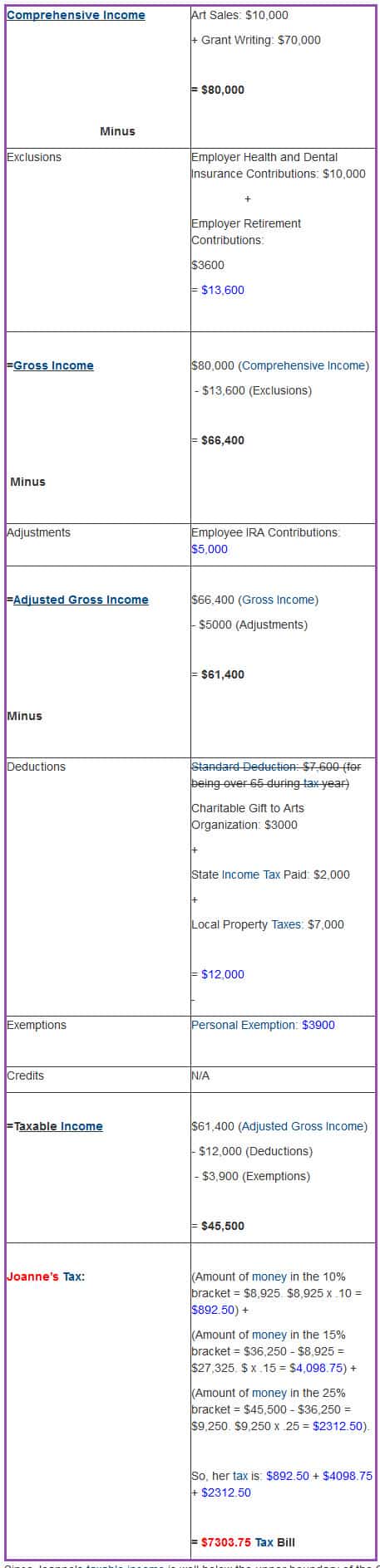

Joanne, artist and activist, 66

Joanne has a tax professional whom she trusts and who has been doing her taxes for the past 15 years. Like Sarah, Joanne has money in all three “piles” that Professor Bartlett talked about: taxable income, income never taxed, and income not taxed now. She has a sense of what things are taxable and what things are not, but she is a little nervous about how her tax bill will change when she retires and starts withdrawing money from her retirement accounts. She decides that she should pay particular attention to Lesson 4 of this Module: Pre- and Post-Tax Dollars, as well as discussing her concerns with her tax preparer.

Below is a brief summary of Joanne’s taxes:

Since Joanne's taxable income is well below the upper boundary of the 25% tax bracket, her taxes would rise by $.25 for every additional dollar of income, and her current "marginal tax rate" would therefore be 25%. Yet she wonders how that might change as she moves into the next stage of her life, when her income will become completely dependent upon the withdrawals from her retirement accounts.

Joanne is curious as to what her "average tax rate" comes out to be. There are a few different ways to measure this. Some people choose gross income as the number they use to calculate their average tax rate, others use adjusted gross income, and still others use taxable income. Joanne decides that using her gross income as a starting point to calculate her average tax rate is the easiest for her to comprehend.

Joanne's tax bill of $7303.75 represents $7303.75(tax bill) / $66,400(gross income), or 11% of her gross income. So, using this measure of income, her average tax rate is 11%.